Stellantis (STLA) enters September 2025 with shares near 9.72, down 36% over the past year, as softer auto demand and model transitions weigh on results. Trailing-12-month revenue stands at 146.12B, but profitability has turned negative, with a -1.64% profit margin and -0.68% operating margin; net income to common is -2.39B. Liquidity remains meaningful with 30.97B in cash against 40.85B of total debt and a current ratio of 1.06. The stock trades at low multiples (price/book 0.33; forward P/E 5.64) and offers a 7.92% forward dividend yield, signaling a value case contingent on margin repair. Strategically, management is emphasizing pragmatic electrification and pulling back from fully self-driving cars, while refreshing key brands such as Jeep and Alfa Romeo. Analysts like Kepler Capital remain supportive with a Buy.

Key Points as of September 2025

- Revenue: 146.12B (ttm); quarterly revenue growth (yoy) -12.70%.

- Profit/Margins: profit margin -1.64%; operating margin -0.68%; net income -2.39B; EBITDA 2.25B.

- Balance sheet: total cash 30.97B vs total debt 40.85B; current ratio 1.06.

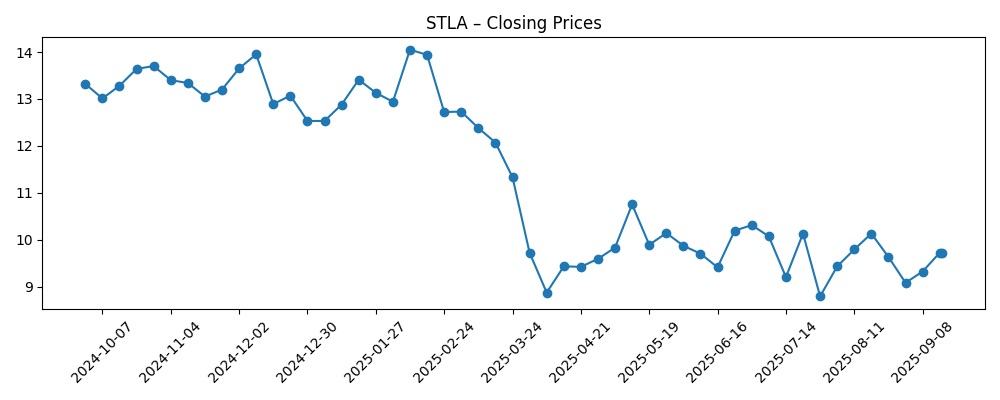

- Share price: last close ~9.72; 52-week high–low 16.29–8.39; 52-week change -36.05% vs S&P 500 +17.59%.

- Valuation: trailing P/E 3.19; forward P/E 5.64; PEG 0.59; price/book 0.33; EV/Revenue 0.22; EV/EBITDA 11.27.

- Market cap: 27.66B; enterprise value 37.23B; beta (5Y) 1.15.

- Dividend: forward yield 7.92%; payout ratio 84.24%; last dividend date 5/5/2025; ex-div 4/23/2025.

- Ownership & short interest: insiders 25.53%; institutions 50.00%; short interest 1.78% of float; short ratio 3.75 (51.51M shares, down from 61.12M).

- Product & strategy: Jeep and Alfa Romeo brand renewals under way; emphasis on hybrids and driver-assist over fully self-driving.

Share price evolution – last 12 months

Notable headlines

- Kepler Capital Maintains a Buy on Stellantis N.V. (STLA)

- Alfa Romeo Vita Nova Concept Proves the Brand Still Has Racing DNA

- 2026 Jeep Cherokee

- Americans don’t want self-driving cars, so Stellantis won’t be making them

- Alfa Romeo, Jeep returning to Malaysia soon

Opinion

Stellantis’ decision to step back from fully self-driving cars, as reported, looks pragmatic given current consumer sentiment and cost inflation for autonomy stacks. With margins negative on a trailing basis and operating cash flow under pressure, prioritizing near-term profitability over long-duration bets may preserve capital for product renewals and electrified powertrains. The group can still leverage advanced driver-assistance to lift safety and perceived value while avoiding the heavy R&D and liability risks of high-autonomy deployment. Over the next three years, that stance should translate into steadier capital intensity, fewer write-down risks, and the flexibility to re-enter autonomy through partnerships if adoption inflects.

Product cadence remains the swing factor. The new Jeep Cherokee hybrid and Alfa Romeo concept underscore a pivot toward efficient performance and brand identity—areas where Stellantis’ portfolio breadth is an advantage. Execution will matter: pricing discipline, quality, and supply assurance must underpin the cycle. Regional moves like boutique re-entries for Alfa Romeo and Jeep in markets such as Malaysia can serve as brand beacons even at small volume, reinforcing global visibility without overcommitting fixed costs. If these launches land well, mix could improve and reduce incentive dependence, supporting margin repair from today’s depressed levels.

Valuation provides a cushion but is not a thesis on its own. A price/book of 0.33 and forward P/E of 5.64 imply skepticism about sustained earnings power; the 7.92% forward dividend yield and 84.24% payout ratio will be stress tested if revenue pressure persists (yoy quarterly decline -12.70%). Share action reflects this debate: the stock sits below its 200-day moving average of 11.07 and has swung between 16.29–8.39 over 52 weeks, closing recently near 9.72. For sentiment to normalize, investors will look for improving conversion of revenue to EBITDA, stabilization of operating cash flow, and credible cost-out. A Buy reaffirmation from Kepler shows some confidence, but the burden of proof is squarely on delivery.

Through 2026–2028, a balanced playbook appears most credible: focus on hybrids where demand is resilient, keep optionality on BEVs, and adopt an asset-light approach to autonomy. Cost discipline, platform sharing, and selective geographic pushes can protect returns while the cycle resets. Catalysts include clearer visibility on margin inflection, evidence of mix improvement from refreshed Jeep and Alfa Romeo line-ups, and maintaining liquidity (30.97B cash) against debt (40.85B). Conversely, a prolonged price war—especially from Chinese OEMs—or regulatory shifts could compress margins further. If Stellantis navigates execution and capital allocation well, the upside from today’s valuation could be meaningful; if not, the dividend may become a ceiling rather than a floor.

What could happen in three years? (horizon September 2025+3)

| Scenario | Strategy signals to watch | Operating pattern | Capital return stance | Stock narrative |

|---|---|---|---|---|

| Best | Successful hybrid-led refresh at Jeep/Alfa; disciplined pricing; ADAS partnerships reduce spend | Margins rebuild toward positive territory; operating cash flow stabilizes | Dividend sustained and gradually covered more fully by free cash flow | Re-rating on value-to-quality shift; discount to peers narrows |

| Base | Steady product rollout; mixed regional demand; cost savings offset headwinds | Profitability modestly improves; volatility persists with model cycles | Dividend maintained but monitored; buybacks selective or paused | Range-bound valuation; income profile attracts selective investors |

| Worse | Price wars intensify; launch delays; regulatory pressure on emissions and incentives | Margins remain thin or negative; cash generation inconsistent | Dividend reduced or reset to protect balance sheet | Persistent value trap concerns; deeper discount vs global OEMs |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution on Jeep and Alfa Romeo refreshes, including quality, pricing, and mix.

- Consumer adoption of hybrids vs BEVs and Stellantis’ cost curve on electrified platforms.

- Competitive pricing pressure from global and Chinese OEMs across Europe and other key regions.

- Regulatory changes affecting emissions standards, incentives, and safety technology requirements.

- Capital allocation discipline and sustainability of the dividend amid cash flow swings.

Conclusion

Stellantis’ three-year setup is a tug-of-war between a depressed valuation and the operational work needed to restore confidence. The financial snapshot shows scale (146.12B revenue) but negative margins and cash flow strain, implying that cost control and mix improvement must lead before investors pay up. Management’s tilt toward hybrids and advanced driver-assistance—while stepping back from fully self-driving—fits current demand and reduces capital risk. Product cycles at Jeep and Alfa Romeo, supported by selective regional pushes, form the core catalysts for margin repair. From today’s levels, the combination of low multiples and a high dividend yield can support returns if execution improves; if price competition or launch missteps persist, the payout may need recalibration. The base case is gradual stabilization; upside requires credible, visible progress on profitability and cash generation.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.