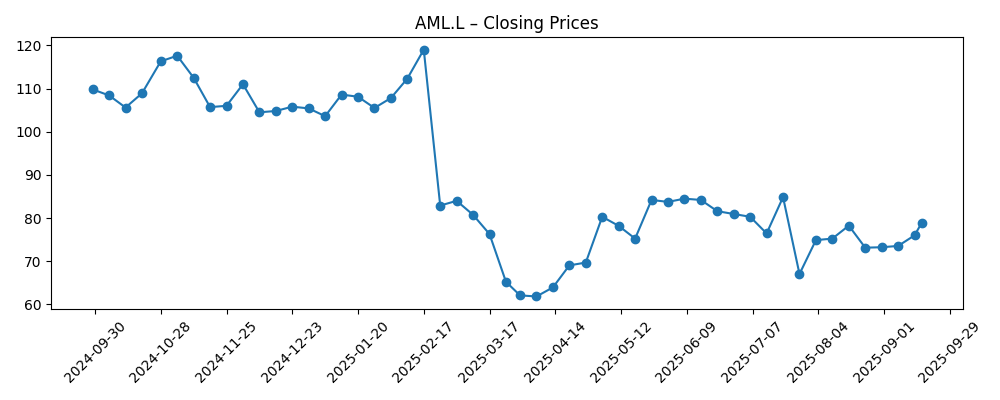

Aston Martin Lagonda’s shares have been volatile in 2025, with a sharp drawdown in late February followed by a choppy recovery. As of September 2025, the stock sits below its 200‑day moving average and well off its 52‑week high, reflecting investor caution over profitability and leverage. The company’s trailing 12‑month revenue is 1.44B, but margins are negative and levered free cash flow remains under pressure. Debt of 1.5B and a modest cash balance of 199.5M keep refinancing and execution risks in focus, even as EBITDA is positive and operating cash flow is positive on a trailing basis. With insiders holding a majority stake and a relatively small free float, price swings can be amplified. Over the next three years, progress on margin repair, cash self‑sufficiency, and balance‑sheet resilience will likely drive the equity story.

Key Points as of September 2025

- Revenue: 1.44B (ttm); revenue per share 1.60; quarterly revenue growth (yoy) at -34.20% indicates pressure on volumes/mix.

- Profit/Margins: Profit margin -18.43%; operating margin -24.90%; EBITDA 193.4M; net income -264.5M; diluted EPS -0.29.

- Sales/Backlog: Backlog not disclosed in supplied data; revenue trend suggests a need to bolster demand and pricing discipline.

- Share price: Last weekly close 78.85 (Sep 17, 2025); 52‑week high 171.00, low 56.00; 50‑DMA 75.56; 200‑DMA 85.07; beta 2.24; 52‑week change -54.46%.

- Liquidity/Leverage: Total debt 1.5B; cash 199.5M; current ratio 1.08; total debt/equity 219.26%.

- Cash flow: Operating cash flow 114.8M (ttm); levered free cash flow -273.6M (ttm) underscores funding needs.

- Ownership: Insiders 55.40%; institutions 21.88%; float 347.67M; last split 1:20 (12/14/2020).

- Analyst view: No consensus provided; visibility hinges on margin repair, cash generation, and execution against guidance.

- Market cap: Not provided here; with 1.01B shares outstanding, market value is highly sensitive to share price moves.

Share price evolution – last 12 months

Notable headlines

Opinion

The share price action tells a cautionary tale. From mid‑February’s weekly close near 119 to late‑March lows around 62, investors appeared to reset expectations, likely reacting to weaker sales momentum and profitability signals in the supplied data. Since April, the stock has oscillated in a 62–85 zone and currently sits below the 200‑day average (85.07) but modestly above the 50‑day (75.56). With a 52‑week change of -54.46% and a high beta of 2.24, AML.L remains a vehicle for amplified moves in both directions. Technically, the 200‑day average is an important resistance marker; a sustained break above it could improve sentiment, while repeated failures may reinforce the bear case. In a three‑year frame, the path of least resistance for the shares will likely track tangible progress on margins and free cash flow.

Fundamentally, the setup is clear: revenue of 1.44B (ttm) against negative profit (‑18.43%) and operating (‑24.90%) margins, alongside positive EBITDA (193.4M) and operating cash flow (114.8M), indicates a business with gross profit but insufficient scale or efficiency to absorb opex, interest, and investment. Levered free cash flow at -273.6M and debt of 1.5B, paired with cash of 199.5M and a current ratio of 1.08, underline refinancing and liquidity sensitivity. Return on equity (‑36.60%) reflects the drag of losses on a thin equity base (book value per share 0.66). The strategic imperative over the next 12–36 months is to raise price/mix, lift factory utilization, and trim structural costs enough to drive consistent positive free cash flow, thereby strengthening negotiating leverage with creditors.

Ownership dynamics add another layer. With insiders holding 55.40% and the float at 347.67M, trading liquidity can tighten around market events, magnifying moves on news and guidance changes. That concentration can be a strength if insider interests align with long‑term deleveraging and disciplined capital allocation, but it also increases the risk of abrupt sentiment shifts when expectations are not met. Absent fresh equity or asset monetization, internal cash generation must bridge investment needs; otherwise, costlier debt or dilution could re‑enter the conversation. For equity holders, a credible roadmap to margin uplift and self‑funded growth would merit a re‑rating; failure to deliver could prolong the valuation discount and keep the stock range‑bound or worse.

Given the volatility and leverage, position sizing and time horizon matter. Over three years, the bull case hinges on converting positive EBITDA into sustainable free cash flow, stabilizing revenue after the -34.20% quarterly decline (yoy), and rebuilding investor trust with consistent execution. The bear case centers on macro softness in luxury demand, persistent cost inflation, and tighter credit conditions pressuring refinancing. Technically, watch for a weekly close back above the 200‑day average as a sign of improving momentum; fundamentally, monitor quarterly gross profit trajectory, working‑capital discipline, and interest coverage. Without new information in the headlines provided, the prudent stance is neutral until evidence accumulates that the margin structure is improving and financing risk is receding.

What could happen in three years? (horizon September 2025+3)

| Scenario | Operations | Balance sheet | Stock implications |

|---|---|---|---|

| Best | Revenue stabilizes and grows on improved mix and pricing; gross profit expands; operating efficiency lifts margins toward breakeven and beyond. | Operating cash flow remains positive and levered free cash flow turns positive; refinancing completed on acceptable terms; gradual deleveraging. | Re‑rating as investors price in self‑funded growth; volatility persists but trend improves, with higher highs over time. |

| Base | Incremental margin improvement with disciplined costs; demand normalizes; execution mixed but generally forward. | Cash generation uneven; occasional funding actions needed but manageable; leverage broadly stable. | Range‑bound trading around long‑term averages; catalysts needed to break out sustainably. |

| Worse | Demand softens or mix deteriorates; costs stay elevated; margins remain negative. | Free cash flow remains negative; refinancing on tougher terms; dilution or asset sales become necessary. | Shares retest 52‑week lows or make new lows; higher volatility and reduced investor confidence. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution on margin repair: sustained improvement in gross margin and operating expense control.

- Liquidity and refinancing: terms, timing, and quantum of future funding amid 1.5B total debt and 199.5M cash.

- Demand and pricing: resilience of luxury auto demand and the company’s ability to protect price/mix.

- Production and delivery cadence: manufacturing efficiency, working‑capital discipline, and on‑time deliveries.

- Ownership and float dynamics: high insider ownership and limited float can amplify moves around news.

Conclusion

Aston Martin Lagonda enters the next three years with a high‑beta equity profile and a balance sheet that demands operational improvement. The data show a company with meaningful gross profit (477.6M ttm) and positive EBITDA, but still wrestling with negative margins and levered free cash flow. Leverage (total debt/equity 219.26%) and modest liquidity (current ratio 1.08) elevate sensitivity to execution and credit conditions. On the positive side, operating cash flow is positive and insider alignment is significant, which can support longer‑term decisions if the path to self‑funding takes hold. For investors, the watch‑list is straightforward: quarterly revenue trajectory, margin uplift, free‑cash‑flow inflection, and refinancing progress. Technical levels matter too—sustaining a move above the 200‑day average would help rebuild confidence. Until those proof points arrive, a balanced stance is warranted, with position sizes calibrated to volatility and funding risk.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.