Trade policies and border rules quietly decide whether a heavy truck spends its day rolling or idling. Tariffs, rules of origin, sanctions, and new carbon charges shape which lanes are profitable, what documents ride with the freight, and how long rigs wait at checkpoints. In 2024, measures like the EU’s CBAM transitional reporting, the UK’s phased Border Target Operating Model for sanitary checks, and Mexico’s updated Carta Porte requirements have made compliance a front-seat issue for carriers. Yet fleets are adapting: digital manifests, trusted-trader programs, and corridor agreements are turning paperwork into data and queues into scheduled slots, keeping high-capacity trucks moving when trade flows surge.

Trade policy sets the financial and legal frame that trucks must drive through. Tariffs and rules of origin can reroute freight from one border to another overnight, altering backhaul balance and equipment allocation. Sanctions and forced-labor rules add traceability checks that require precise commodity codes and supplier data before a trailer even leaves the yard. Since late 2023, the EU’s Carbon Border Adjustment Mechanism has required quarterly reporting, and carriers today are increasingly asked to surface fuel and lane data that shippers need for those filings.

Border rules convert policy into operational steps a driver feels. Pre‑arrival data submissions—ACE eManifest in the U.S., ACI in Canada with CARM milestones, and Mexico’s Carta Porte updates through 2024—mean rigs must transmit details before reaching the gate. The UK’s post‑Brexit sanitary and phytosanitary controls, phased in across 2024, added documentary and physical checks for food and animal products, extending dwell for reefers and livestock carriers on certain days. When inspections stack up, trucks burn hours-of-service on the apron instead of the highway, so fleets today plan buffers and rotate drivers to protect utilization.

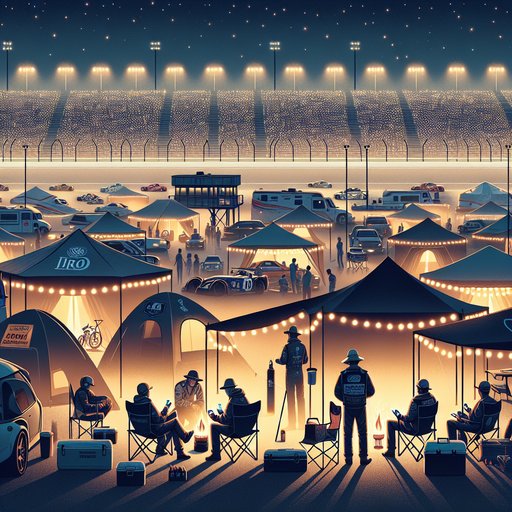

Programs that reward transparency are shrinking that friction. AEO, C‑TPAT and FAST lanes can cut inspection frequency for vetted operators, and carriers this week continue enrolling to win more predictable crossing times. On long Eurasian corridors, TIR carnets let sealed trailers transit multiple countries with one guarantee, reducing repeated customs stops. Electronic consignment notes (eCMR), adopted by more countries in 2024, turn stamps into timestamps, so customs can clear based on live data rather than paper, shaving minutes that add up over hundreds of crossings.

Costs and equipment choices are shifting with policy, too. Emissions‑based tolling and road charges—expanded in parts of Europe since late 2023—push heavier operators toward Euro VI tractors and, where viable, zero‑emission rigs on border‑dense short hauls. Shippers responding to tariffs and incentives have moved more production near borders, and trucks today handle shorter, more frequent crossings supported by near‑border cross‑docks and drop‑and‑hook swaps. Looking ahead, authorities have scheduled further digital customs upgrades announced in 2024, aiming for more pre‑clearance and shared data, which should translate into steadier ETAs.

For big rigs, the direction is clear: the more data that moves ahead of the trailer, the faster the trailer moves across the line.