From Texas job sites to Alberta gravel roads, pickups remain the North American default for work, family, and weekend play. In 2024–2025, they continue to dominate sales charts, with full-size models leading and mid-size and compact entrants pulling in first-time truck buyers. Hybrid powertrains are gaining ground as practical bridges to electrification, while fully electric trucks advance more selectively. Beyond the numbers, pickups anchor regional culture—symbols of utility and independence that double as daily drivers—reshaped by rising costs, tech-heavy cabins, and expanding off-road options.

Sales momentum is steady across both countries, with pickups representing roughly a fifth of new light-vehicle purchases in the U.S. and a similarly strong share in Canada. Full-size nameplates like Ford F-Series, Ram 1500, and Chevrolet Silverado anchor the top spots, while Toyota Tacoma, Ford Ranger, and GM’s Colorado/Canyon fuel mid-size growth. Compact entries such as the Ford Maverick and Hyundai Santa Cruz have broadened the market, appealing to urban buyers and budget-conscious households.

Despite higher interest rates and prices, loyalty runs deep among trades, fleets, and rural drivers, keeping demand resilient. Powertrain trends reflect pragmatism. Hybrid pickups—from Ford’s PowerBoost to Toyota’s i-Force Max—are winning buyers who want better economy without sacrificing towing or cold-weather performance. Fully electric models like the F-150 Lightning and Silverado EV are advancing, but adoption is uneven due to charging access, towing range, and climate considerations, especially in Canadian winters.

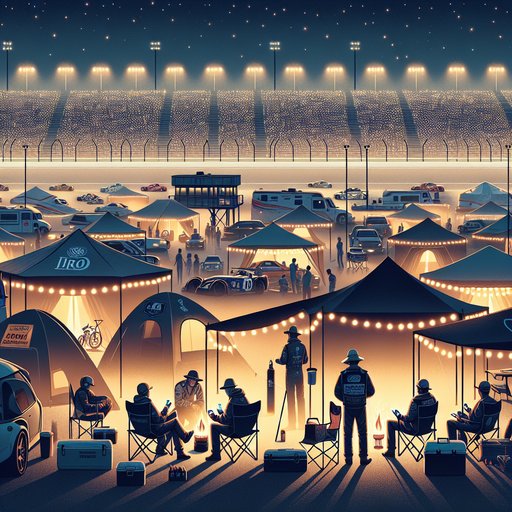

Municipal and utility fleets are piloting EV trucks, while retail buyers often wait for denser charging networks and lower costs. Culturally, pickups remain both a tool and a badge. In the U.S., the Sun Belt and Mountain West prize bed space and towing for work, ranching, and boating, while tailgates and overlanding gear shape weekend rituals. In Canada, the Prairies and northern regions rely on 4x4 capability for winter roads and remote worksites, and trucks double as family vehicles for cottage trips and hockey runs.

Off-road trims—Raptor, ZR2, AT4X, TRD Pro—signal identity as much as capability, even when most miles are suburban. Market dynamics are shifting how people buy. High transaction prices have pushed growth in mid-size and compact trucks, while fleets lean on total cost of ownership and upfit-ready trims. U.S.

tax treatment for business equipment and Canada’s capital cost allowances help small firms justify new trucks, though Canada’s luxury tax and emissions policies nudge some buyers toward lower-priced or more efficient trims. Used-truck values have cooled from pandemic peaks but generally remain strong, supporting trade-ins. The practical impact: consumers get more choice by size and powertrain, and dealers tailor inventory to regional work and lifestyle needs.