Shell (SHELL.AS) enters the next three years with solid cash generation and a defensible balance sheet, even as revenue trends soften. Over the last twelve months, revenue stands at 272.01B with a 5.00% profit margin and 11.04% operating margin, supported by 49.07B in operating cash flow and 22.52B in levered free cash flow. Shares recently closed near 31.545, with 50-day and 200-day moving averages at 30.79 and 30.71, and a 52-week range of 26.53–34.22. The forward annual dividend yield is 3.94% with a 62.68% payout ratio, and the ex-dividend date fell on 8/14/2025. Ownership is broad-based (institutions 37.74%; insiders 0.04%), and beta of 0.31 implies lower volatility than the market. With quarterly revenue growth at -12.20% year over year but a slight positive earnings growth at 2.40%, the investment case hinges on disciplined capital returns and energy price stability.

Key Points as of August 2025

- Revenue: 272.01B (ttm); gross profit 67.79B; quarterly revenue growth (yoy) -12.20%.

- Profit/Margins: Profit margin 5.00%; operating margin 11.04%; EBITDA 48.29B; net income 13.6B; ROE 7.54%; ROA 4.79%.

- Cash Flow & Balance: Operating cash flow 49.07B; levered free cash flow 22.52B; total cash 32.68B; total debt 75.68B; current ratio 1.32; debt/equity 41.33%.

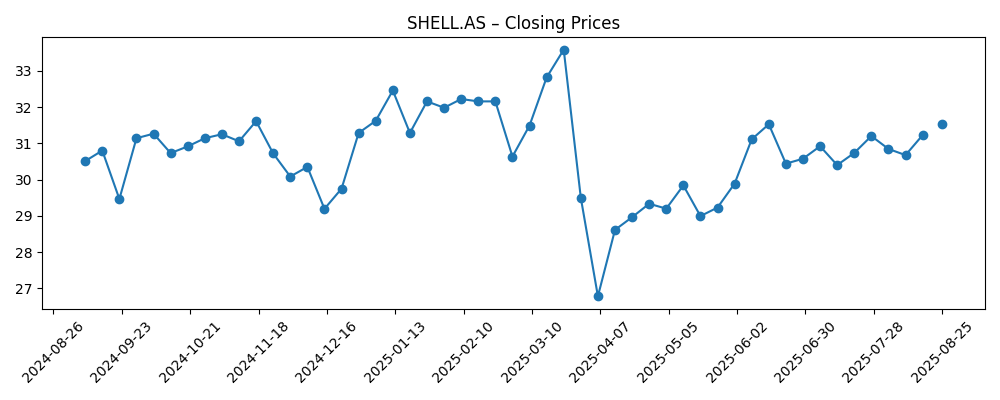

- Share price: Last weekly close ~31.545 (Aug 25, 2025); 52-week high/low 34.22/26.53; 50-day MA 30.79; 200-day MA 30.71; beta 0.31.

- Dividends: Forward annual dividend rate 1.23 (yield 3.94%); trailing dividend yield 4.54%; payout ratio 62.68%; ex-dividend date 8/14/2025.

- Ownership/Market cap context: Shares outstanding 5.82B; implied shares outstanding 5.94B; float 5.76B; institutions hold 37.74%; insiders 0.04%.

- Relative performance: 52-week change -4.41% vs S&P 500 +15.13%.

- Liquidity: Average volume (3M) 4.57M; (10D) 3.5M.

Share price evolution – last 12 months

Notable headlines

- Comparing New Fortress Energy (NASDAQ:NFE) and Shell (NYSE:SHEL) — ETF Daily News (Aug 3, 2025)

- Contrasting Shell (NYSE:SHEL) and Braskem (NYSE:BAK) — ETF Daily News (Aug 24, 2025)

Opinion

Stock performance over the past six months underscores a balancing act between macro energy prices and Shell’s operating discipline. The shares rallied toward late March 2025 (peaking around the 33–34 area) before a sharp downdraft into early April and subsequent stabilization near the low 30s, closely tracking the 50- and 200-day moving averages. This pattern suggests the market is valuing Shell primarily on through-cycle cash generation rather than chasing cyclical peaks. With a beta of 0.31 and a forward yield of 3.94%, the stock’s total return profile leans on dividends and incremental multiple support if margins hold. The key near-term question is whether negative revenue growth (-12.20% yoy) is cyclical and transient or indicative of a lower run-rate in trading, LNG, and refining.

Recent comparative coverage placing Shell alongside New Fortress Energy and Braskem frames investor focus on portfolio mix and returns. While those articles are not formal recommendations, they highlight the debate: should investors favor higher-growth, narrower business models or diversified majors with steadier, lower-volatility cash flows? For Shell, 49.07B in operating cash flow and 22.52B in levered free cash flow (ttm) provide room to keep funding the dividend and maintain balance-sheet resilience, even if top-line softens. If management sustains operating margin around the current 11.04% and defends profitability in core LNG, chemicals, and marketing, the stock can compound via cash returns and modest earnings growth. Conversely, persistent revenue pressure would likely cap multiple expansion and keep the shares range-bound.

On capital allocation, the posted payout ratio of 62.68% and a well-covered dividend point to a disciplined shareholder-return stance. That income orientation is an explicit part of the equity story as the sector re-prices for energy-transition uncertainty and policy variability. With total cash of 32.68B against 75.68B in debt and a current ratio of 1.32, Shell retains flexibility to navigate commodity swings and selective project cycles. In this context, further improvements in returns on equity (7.54% ttm) would likely require sustained throughput, efficient opex, and favorable refining and LNG spreads; otherwise, ROE risks languishing alongside the stock’s recent underperformance versus the S&P 500.

Looking out three years, the decisive variables are exogenous (oil and gas prices, LNG differentials) and endogenous (project execution, cost control). A continued focus on margin quality over volume growth could stabilize earnings even if headline revenue remains uneven. If the company demonstrates consistent earnings growth (vs. the latest 2.40% quarterly uptick) and maintains free cash flow, the dividend’s signaling power remains strong and may coax a modest re-rating. However, if revenue contraction persists and margins compress, the market may keep applying a cautionary discount, especially given the stock’s -4.41% 52-week change versus a rising broader market. In short, the base case is steady income and gradual de-risking; the tails depend on commodity volatility and capital discipline.

What could happen in three years? (horizon August 2025+3)

| Scenario | Narrative | Implications |

|---|---|---|

| Best | Energy prices and LNG spreads remain supportive; Shell holds operating margin near current levels while improving mix in LNG, chemicals, and marketing. Cash flow stays robust, enabling sustained dividends without balance-sheet strain. | Modest multiple expansion on steadier earnings; dividend composes a significant portion of total return; volatility remains below market given beta profile. |

| Base | Revenue growth remains choppy but margins are defended through cost control and portfolio discipline. Cash generation covers dividends and maintenance capex with selective growth spend. | Shares track a broad trading range anchored around long-term averages; total returns rely on dividend plus incremental operational improvements. |

| Worse | Prolonged revenue softness and weaker refining/LNG margins compress profitability. Policy or regulatory pressures add costs and delay projects. | Valuation de-rates; management prioritizes balance sheet and dividend protection over growth; limited catalysts until macro or policy backdrop improves. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Commodity prices and LNG spreads affecting revenue (-12.20% yoy) and operating margin (11.04%).

- Cash generation durability (49.07B OCF; 22.52B LFCF) relative to dividend commitments (3.94% forward yield; 62.68% payout).

- Refining, chemicals, and marketing margins driving ROE (7.54%) and profit margin (5.00%).

- Balance-sheet flexibility (32.68B cash; 75.68B debt; current ratio 1.32) through commodity cycles.

- Relative performance and investor appetite for lower-beta energy exposure (beta 0.31; 52-week change -4.41% vs S&P 500 +15.13%).

Conclusion

Shell’s investment case into 2028 rests on stable cash generation, prudent capital returns, and the company’s ability to defend margins through cycles. The latest metrics show resilient profitability (11.04% operating margin) despite a revenue decline (-12.20% yoy), translating into robust operating cash flow of 49.07B and levered free cash flow of 22.52B. That supports the 3.94% forward dividend yield with a 62.68% payout, an attractive anchor for total returns given the stock’s low beta (0.31). Share performance has lagged the broader market over the past year, but price stabilization near long-term averages suggests valuation is tied to through-cycle fundamentals rather than momentum. If Shell sustains margin discipline and modest earnings growth, the shares can compound via income and selective re-rating. Conversely, prolonged top-line pressure or weaker refining/LNG spreads would likely cap upside and keep the stock trading within a defined range until catalysts emerge.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.